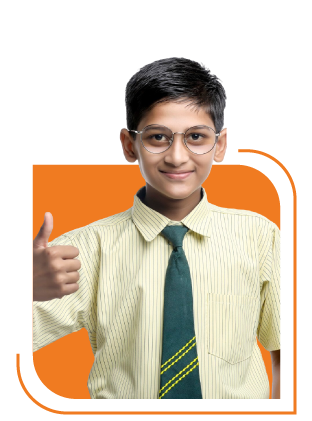

ArthaBodh – Best Financial Literacy Programme for children

ArthaBodh is India’s one of emerging financial literacy platforms that equips children and young adults with essential monetary skills.

Today’s financially educated child will make tomorrow’s money-wise adult.

Our Vision

- Transportation

- Outdoor Games

Our Mission

Helping young minds develop the right attitude and skills to effectively manage finance.

ArthaBodh – Best Financial Literacy Programme for children

ArthaBodh is India’s one of emerging financial literacy platforms that equips children and young adults with essential monetary skills.

Today’s financially educated child will make tomorrow’s money-wise adult.

Our Vision

- Transportation

- Outdoor Games

Our Mission

Helping young minds develop the right attitude and skills to effectively manage finance.

ArthaBodh's Sessions At A Glance

Programme Content

- History of Money

- Needs and Wants

- Budgeting

- Borrowing and Spending

- Banking System

- Importance of Saving

- Assessment test

- History of Money

- Needs and Wants

- Budgeting

- Borrowing

- Banking System

- Introduction to Various Financial Markets

- Different Investment Vehicles

- Assessment test

- Journey Of Money (Till crypto currency)

- Needs and Wants

- Budgeting

- Borrowing

- Banking System

- Importance of saving and other Investment options

- Importance to stock market,Mutual Fund and Insurance

- Introduction to tax and various government schemes

- Assessment test

Services

Financial Education for Children

Activity Based coaching (Game ,Role Play, quiz etc) for fun filled learning experience.

Financial Product Distribution

Watch this space for further updates.

Education Technology Services

Watch this space for further updates.

Will Be Happy With Our Activities

Summer Camp

Magna aliquaenim minim veniam nostrud exercit ation ullamco laboris.

Music Club

Magna aliquaenim minim veniam nostrud exercit ation ullamco laboris.

Museum Visit

Magna aliquaenim minim veniam nostrud exercit ation ullamco laboris.

Math Club

Magna aliquaenim minim veniam nostrud exercit ation ullamco laboris.

Sports Training

Magna aliquaenim minim veniam nostrud exercit ation ullamco laboris.

Clear & Cleaning

Magna aliquaenim minim veniam nostrud exercit ation ullamco laboris.

Frequently Asked Questions

ArthaBodh’s Financial Literacy Programmes are designed for which age groups?

ArthaBodh has designed its sessions on Financial Literacy for below age groups:

- Beginner’s Level: Age Group 10 to 12

- Advance Level: Age Group 13 to 15

- Expert’s Level: Age Group 16 to 18

Why financial education is required for children?

Money being an integral part of children’s lives.

- Children handle money at an early age, compared to earlier generations.

- Children have greater spending power and increasing say in buying decisions

- We provide education on all aspects of life to them – except financial discipline.

- Financial discipline as a habit at an early age will stay for the rest of their lives.

- This program builds the skills required to develop a financial acumen in children.

Why should I choose ArthaBodh Financial literacy program for my Child?

Parents try to educate their children in all aspects of life at early age so that he/she will be ready to face future challenges, however there is very little or almost no education provided to kids on finance or Money matter.

We, at ArthaBodh believe that like any other subject if finance is also taught to children at an early age, then financial management will become a habit which will yield life long benefits for the children.

How can I register for ArthaBodh’s financial education program?

To register for this program, click on the ‘Register Now’ tab present in the Program Content section. This will guide you to the registration form. On successful submission of registration form an auto generated email will be sent which will confirm your registration for the course.

How can I attend the ArthaBodh sessions?

ArthaBodh’s sessions are available Online, Offline and Do-Your-Own (Sessions at your own pace).

Ages We Meet Kids Where They Are

First School (1 - 2 Years)

Lorem ipsum dolor sit amet consectur adipiscing elit sed eius mod ex tempor incididunt labore dolore magna aliquaenim ad minim eniam.

Preschool (2 – 3 years)

Lorem ipsum dolor sit amet consectur adipiscing elit sed eius mod ex tempor incididunt labore dolore magna aliquaenim ad minim eniam.

Kindergarten (3 – 5 years)

Lorem ipsum dolor sit amet consectur adipiscing elit sed eius mod ex tempor incididunt labore dolore magna aliquaenim ad minim eniam.

Course Instructors

Shweta Desai

Co-Founder and FacultySuruchi Deshpande

Co-Founder and FacultyMadhura Kshirsagar, CFA

Leading FacultyParul Dhamapurkar

Leading FacultyWhat Our Students and Parents

Have To Say

All the sessions were very informative. Teaching methods were very good. All concepts were explained properly. All sessions were conducted enthusiastically.

Tanishka, 7th Std

StudentI enjoyed all the sessions. Sessions were informative. Teaching method was interactive. Thus, all the students could take part in the discussions. The faculties made sure that all the doubts are clear. All FINANCE or MONEY related topics were covered.

Rahul, 9th Std

StudentGreat course content. Teaching method was interactive. Madam’s methodology to explain any topic was excellent. The topics covered were interesting and method of teaching was interactive, did not get bored during sessions.

Sahil Rao, 8th Std

StudentPERFECT!!!! Loved all the sessions. Fantastic. Ma’am is very enthusiastic. Surely recommend it to my friends.

Anvita Degawekar, 9th Std

StudentI learnt many new concepts in the sessions. Like Fixed Deposits, Recurring Deposits, Stocks, Share Market, Mutual Funds, how and where to invest money… All concepts covered are needed in our daily lives. Teachers were friendly. Teaching method was very good.

Adhokshaj Joshi, 8th Std

StudentSessions were good. I enjoyed all of them. It was step by step and nice.

Tanvi Joshi, 8th Std

StudentThis is one of the best courses I have ever attended till now. Very good experience attending the session. I thought FINANCE was boring. But the teaching method made it interesting and easy to understand.

Yatharth Sutar, 8th Std

StudentMy daughter has attended ArthaBodh sessions. I am highly impressed with the learning approach followed by ArthaBodh faculty. The learning happens through activity-based scenarios, which helps children to understand difficult concepts of finance. I am sure these sessions will help my kid to develop a life long skill of financial management.

Sandeep Panat

ParentI have gone through the ArthaBodh content which I found very useful and effective. It covers very basic financial concepts which are must for all children to understand. These secessions will inculcate good financial habit in the kids which will stay with them lifelong. I will recommend this course for all children.

Pallavi Gulkari

ParentMy son attended these sessions. I am happy to see the habit he has inculcated for spending money wisely. Similarly he actively participates in our family budget and spending discussions.This program is a must for every child.

Himani Bhat

ParentMy daughter attended Arthabodh sessions. I am delighted to see the impact. She has started talking about this subject passionately. I will recommend this program for all children.

Kalyani Apte

ParentHello Team ArthaBodh, Thank you for your meticulous work on this program. You have elevated this session with your hard work and great ideas. "Wishing you the best of luck in all of your future endeavours.

Kalyani Kadam

ParentHi, Finance management is a new topic for Ved. What is a Bank, why it is needed and how it operates are the concepts he learnt after the sessions and started accompanying us in the banks. He enjoyed learning many other topics. He thoroughly enjoyed the sessions. Thank you, Shweta and Suruchi mam, for your efforts.

Shraddha Thorat

ParentCheck Out Our Latest News

Accounts Receivable (A/R or AR)

- October 19, 2024

- Com 1

A/R, “accounts receivable” is the money a business should receive from its customers for the sales of goods or services...

Accounts Payable (A/P or AP)

- October 19, 2024

- Com 1

When a company purchases goods on credit which needs to be paid back in a short period of...

How does a loan work?

- October 19, 2024

- Com 0

You must be observing a lot of advertisements about various type of...

What is inflation?

- October 19, 2024

- Com 0

If you inflate a car/bike tyre or a balloon, it gets bigger. In finance, inflation is “the rate...

Check Out Our Latest Blog