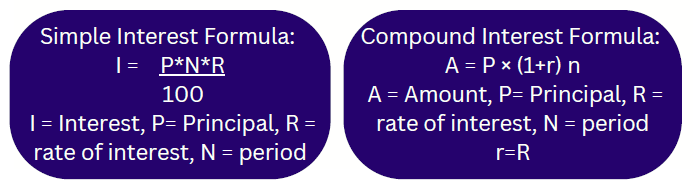

You must be observing a lot of advertisements about various type of loans from different banks. You would have seen advertisements for home loan, personal loan, car loan etc. Normally for large expenses like a house or a car, any person would prefer to spread his expenses over a period, instead of paying the entire amount at one time. This is exactly where taking loan helps you. A loan allows you to spread out the cost of that item across many small payments over time instead of having to pay the full price all at once. For example, if a car costs INR 5,00,000 it’s a lot easier for most people to make a payment of INR 7,546 every month than pay the full amount up front.

Why would a bank or financial institution lend you money? Because they make money by charging interest. You have to pay back the full amount of the loan plus a fee for the right to borrow the money. How much they charge for the loan depends

on the interest rate. Using the same car example, if you borrow INR 5,00,000 from the bank at a 7% interest rate and you have to pay back the loan in 7 years, you would be charged a monthly payment of INR 7,546. This means after 7 years, you actually

pay INR 6,33,893back to the bank. So the bank earns INR 1,33,893 from the loan

Even if you can pay in full for the car, you might prefer to take out a loan. If your INR 5,00,000 would earn more in another investment than you would save by avoiding loan fees, that would be a reason. Or you might just want all or part of the INR 5,00,000 for another purpose rather than spending the full amount all at once. Whatever the reason, it’s important to understand how loans work and the responsibilities that go with borrowing. Always go for a loan in case of your needs like Home, Car etc. rather than your wants like holiday trip,expensive gadgets etc.

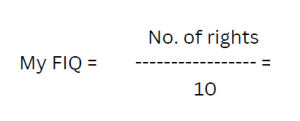

Financial Information Quotient

Read the following statements and mark whether they are true or false:

- One who can spend a lot of money is a wealthy man. _______

- People who regularly spend less than what they earn are more likely to become wealthy thanthose who regularly spend more than what they earn. _______

- Young people do not have to worry about money. _______

- You cannot spend money when your bank account is empty. _______

- One must be 18 years old in order to open a bank account. _______

- It is possible for us to have a share in the profits of many big companies in India. _______

- One cannot open a bank account if one does not have a ration card. _______

- When you save money, it grows. _______

- A person below 18 years of age can apply for a loan from a bank. _______

- One can keep his savings in a post office. _______

What Do You Want to Learn About?

We want to answer your questions! After asking your parents’ permission, write tous at contactus@arthabodh.com and tell us the money questions and issues youwould like to see covered in the next edition of Newsletter.

You Can’t Always Get (all of) What You Want – Appreciate Tradeoffs

Life is all about trade-offs or prioritization – making the choice to do one thing and recognizing how that decision limits or affects other options. For example, if you spend your allowance on a small toy today, it will take you longer to save up for a bigger item. At every stage of your life you would have to prioritize things or make a choice to do one thing hence it’s important to develop the skill to recognize what trade-offs are involved – particularly with decisions about money. Like anything else, you can practice and get better at identifying and evaluating trade-offs. Start with

asking yourself with small purchases:

- Do I actually want this item?

- Is it worth the price?

- Will it bring me happiness or satisfaction and for how long?

- If I use my money for this now, how does that affect what I can buy or do with my money later?

- Would I be happier saving my money for something else?

If you develop this habit of asking yourself these questions, you will end up spending your money wisely since you will likely make fewer impulse buys, have fewer regrets about your spending and feel happier about the things and experiences that you do spend your money on.

Money Fun Facts

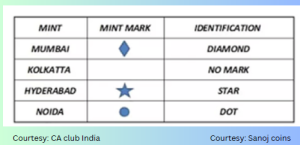

Symbols below the date on your coin indicate where it was minted

In India, coins are minted at four mints: Mumbai, Kolkata, Hyderabad and Noida through Security Printing and Minting Corporation of India Ltd (SPMCIL). Every coin

will have a certain symbol which indicates the place where it has been minted.

- if you see coins which have no symbol below the date, it means they have been

minted at Kolkata - If you see coins with a diamond symbol or a letter ‘B’ or letter ‘M’ below the year, it

means it has been minted at Mumbai Mint - Coins with a star, split diamond or dot in diamond below the year, means that they have been minted at Hyderabad

- Coins with round dots below the year mean that they have been minted at Noida

Mint