A/R, “accounts receivable” is the money a business should receive from its customers for the sales of goods or services on credit. It is the amount of money for which you have issued invoices but have not yet been paid. It is treated as current asset since you sold goods/services on credit (without receiving cash up front) for which you expect cash to be received in short period of time.

Accounts receivable signifies how much cash you are awaiting from unpaid invoices. It is a key indicator of your company’s financial health.

Example:

You are a company A who sold goods to company B on credit (without receiving cash up front). Company B as a customer needs to pay this in short period of time,

generally in 30 days.

Company A will record this transaction as accounts receivable because company A has to receive money from company B.

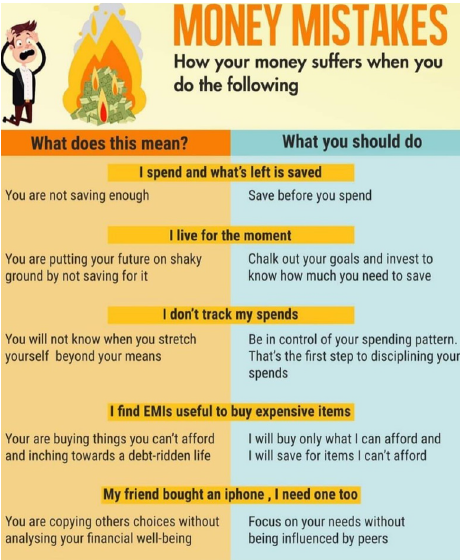

What would you do?

Scenario 1

You really want this cycle but you can not afford it. You have worked out that it will take you two years to save the money then:

- Is it worth waiting that long?

- Will you still want the bike in two years?

- Is saving money a waste of time?

Scenario 2

You are 30 years old and have a good job…

- Will you spend money on a new car or a big holiday?

- Will you save a lot of your money or mainly buy things?

What Do You Want to Learn About?

We want to answer your questions! After asking your parents’ permission, write to us at contactus@arthabodh.com and tell us the money questions and issues you would like to see covered in the next edition of Newsletter.

Money Fun Facts

Interesting facts about Indian Rupees and Coins

- The Government of India’s first set of notes was the Victoria portrait series. For security reasons, the notes of this series were cut in half. One half was sent by

post, and upon confirmation of receipt, the other half was sent. They were replaced by the Underprint series in 1867. - Denominations of 1 paise, 2 paise, 3 paise, 5 paise, 10 paise, 20 paise and 25 paise were in circulation till June 30, 2011 but were then withdrawn.

- If you have a torn note, or more than 51% of its torn part, you can exchange it for a new one at a bank.

- Did you know that except for one-rupee notes and coins everything else is printed by the RBI!

- Only 1 Re note and coins in India are signed by the Finance Secretary as they are printed by the Central Government. All other Indian Currency notes in India are printed by the RBI